When I was Director of Financial Planning at Morningstar, I wrote a column early on that touched on the top ten portfolio pitfalls. Many of the same principles apply today.

What most of us really want is a portfolio that grows steadily, gets us to our goals and manages to avoid the majority of problems we hear and see on the evening news. That is achievable if you’re willing to make a few trade-offs. Let’s walk through ten of the most common pitfalls that can bedevil even the savviest investor’s portfolio.

1. Not Defining Your Objectives

Everything starts with intention. What do you want this money to do? You may have multiple goals: saving for kids’ education, investing so you can have more freedom later in your career, saving for that dream vacation. Each goal has a time horizon and that will affect how you invest.

2. Lack of Diversification

When I see people get into trouble with their investments, it’s usually some kind of over-concentration issue. They have too much in one stock and they don’t see the risk. Maybe they work in the same industry as the security. If something happens to the industry, it could affect the portfolio and the human capital. This can lead to catastrophic losses that can usually be mitigated if we just start diversifying early enough.

One of my favorite reports in Morningstar’s software is the Stock Overlap report. It can x-ray everything in a portfolio (including the stocks inside every fund) to see just how much of each individual stock you own. Think about the FAANG stocks and how much of the stock index funds are invested in them. If you owned some outright and others in funds, you might be surprised just how much you own in some of the largest stocks. Maybe not quite as diversified as you thought!

If you haven’t been rebalancing over the past decade, you may find the growth style of stocks far exceeds the value style. You may want to take some of those profits and reallocate them to underweighted portions of your portfolio. Too much of anything may not be a good idea. If you can do that in a retirement account, you won’t trigger taxes.

Or maybe lack of diversification comes from the excitement of seeing a few big wins in your portfolio. I’ve seen different time periods when lots of people think they are an investing genius because the market shoots up and their couple of stocks make a lot of money. Almost anyone who has been investing long enough can tell you those types of wins can reverse very quickly. And while the geniuses talk about their “killings” in the market, they may neglect to talk about the other stocks that didn’t perform as well as the market as a whole.

Getting the mix of stocks and bonds right for your particular situation is perhaps your most important decision. You don’t have to be a genius to get a good return on your portfolio with a risk level you can sleep with at night over a longer period of time.

3.Being Undisciplined

While it’s helpful to align money and meaning, you still need a way to objectively measure how your investments are doing. You need to have discipline and set your expectations. In other words, you need a plan. The best way I know to do that is through an Investment Policy Statement (IPS). Creating an Investment Policy Statement is a great way to establish beforehand how you’ll deal with the inevitable tough questions, and minimize the impact of emotions.

You’ll need to think about questions like: What is my risk tolerance? Which asset classes should I choose and how much should I allocate per asset class? What risk reduction techniques will I use? Thinking through questions such as these is the difference between having a cohesive investment program and just a collection of funds and/or individual securities.

4. Being Impatient

One thing I’ve learned over the years is to not react too quickly to market conditions. It’s tempting though isn’t it? Sometimes you just want to do something when you’re feeling anxious.

One of the best ways I’ve found to avoid doing this is to simply try to tune out the noise about the market’s day-to-day gyrations. Once you have your portfolio in place, you’ll be far better served by ignoring the screaming and shouting on TV, which will help you avoid jumping in or out of the market. Learn to persevere through the inevitable market drops. Stick to the discipline of your IPS.

5. Getting Greedy

Did your folks ever tell you to keep your eye on the ball? That was good advice. When times are good, lots of people get distracted by the “high” of making money and lose sight of their true goals. They fall into the trap of always wanting more. There’s a famous story of Kurt Vonnegut talking with Joseph Heller while at a party thrown by a billionaire. Kurt commented on the wealth of their host, and Joe Heller responded that he had something their host never would. “Enough.”

If you’re meeting your objectives, don’t get greedy and think the grass

is greener by taking on unnecessary risk. The vast majority of the time, it’s just

not worth it.

6. Ignoring Tax Efficiency

Sometimes I’m surprised how many people fail to consider the tax implications of investing. I’ve seen situations where investors are literally triggering millions in capital gains and not really trying to lower that!

One fairly easy thing you can do to lower taxes is net out capital gains and losses. You can claim $3,000 of capital losses against ordinary income in any year. If you have more losses than you can use right away, you can carry them forward indefinitely. So look at Schedule D on your tax return to see if you have any of those.

We look for capital losses in the portfolio especially in the fourth quarter each year. To the extent we’ve taken capital gains during the year (raising money for expenses, for example), we see if we can net those out with losses in an investment we’re still holding. You want to evaluate the “quality” of those losses before you sell anything. If they are too small, it’s probably not worth selling. If it’s an investment you really want to hold long-term, it may also not be worth taking that loss.

Think about cost basis, especially as someone gets older. In many cases, you can get a step-up in cost basis when that person dies depending on the type of account that holds the assets. That may also play a role in thinking about what to sell and when.

Another technique we use to help keep taxes under control is asset location. With this concept, you think carefully about where to hold different types of investments. If an investment is “inefficient” (it generates taxable income), you may want to hold it in a retirement account. More “efficient” types of assets may be better held in taxable accounts. They can eventually be sold and taxed at lower capital gains rates versus ordinary income rates when you pull money out of a retirement account. Of course, there can be exceptions to this technique depending on what you are trying to do with your assets (generational issues can come into play). Other factors like low interest rates, changing tax laws, and time horizon can also impact this equation.

7. Not Paying Attention to Costs and Value

If there’s one thing I learned from Jack Bogle, it’s that costs matter. I’ve seen investment expenses come down dramatically over the past twenty years. Trading costs are near or at zero. Expense ratios of funds/ETFs are much lower than they were even five years ago. Many people now look at the investment part of financial planning as a commodity. So what are you paying for?

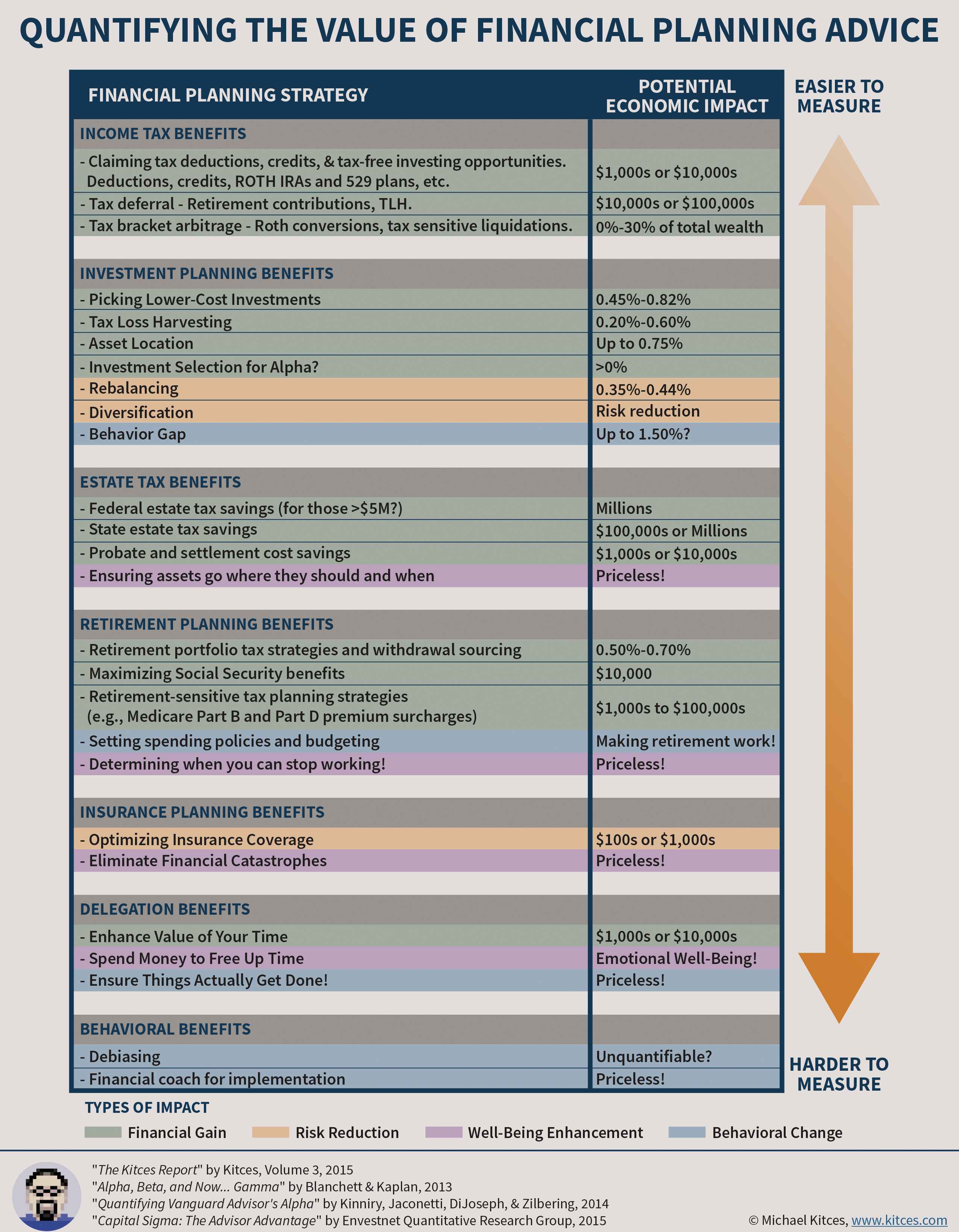

A good financial planner does a lot more than just help choose investments. Our job is to help you avoid making psychological mistakes, encourage you to set and meet goals, waive a red flag when we see you heading down the wrong path. Financial planning is actually the most important part of the experience because it incorporates tax, retirement planning, estate planning, giving to others, saving for important goals like education funding and financial independence. All of these things can add value over time.

Here’s what my colleague Michael Kitces has to say about the value of an advisor:

When you think about working with an advisor, think about the entire experience. Most advisors work with a combination of technology tools (portals, online planning, apps, podcasts, targeted content) and the human touch of providing a sounding board for life’s most important decisions. Finding a partnership with someone you respect and trust is worth something. If you haven’t found it yet, keep looking. Only you know what you need and how you want to prioritize that.

8. Rebalancing Too Often or Too Little

Even the most finely tuned portfolios will see their asset allocation drift over time, as some asset classes do better than others. While relatively minor changes (plus or minus a few percentage points or so) aren’t necessarily worrisome, it is possible that your allocation has shifted dramatically if you haven’t given it much attention over the past several years. If that’s the case, you might be taking on more risk than you intend to.

When rebalancing your portfolio, consider the type of accounts you hold. If you invest primarily in tax-deferred accounts, you can rebalance back to your original allocation without any harmful tax consequences.

If, on the other hand, you need to rebalance assets that have appreciated in a taxable account, you need to weigh the tax implications of selling and recognizing capital gains with taking on more risk than you’re comfortable holding. While taxes are important, it generally makes sense to consider your objectives and make sure your portfolio allocation is appropriate to reach your goals.

Successful investing is about managing risk, not avoiding it.

Benjamin Graham

9. Keeping Adequate Liquidity

When you depend on your portfolio for income, or you have a shorter-term goal in sight, having adequate liquidity provides much peace of mind. If you have a goal that you want to meet in less than a year, you probably shouldn’t be in the stock market.

Having an emergency reserve is important at any age. When you’re younger, keeping about six months expenses in a cash-like account can cover emergencies. As you get older, you may want to keep a couple years’ worth of expenses in cash equivalent types of investments. If you lost your job unexpectedly, this money could help tide you over. A line of credit on your home can also help provide some liquidity if you really need it.

10. Not Aligning with Your Values

The first book in my Dreams of Wealth™ series is Put Your Money Where Your Heart Is. There are many implications from this: use your money for experiences that you value, use your money to help others through philanthropy or invest in a way that aligns money and meaning.

You don’t have to layer in ESG if that’s not for you. But you’re more likely to stay the course if your portfolio stands for something that you can stick with no matter what the markets are doing at the moment.

This checklist is one of many offered through Financial Planning Literacy, part of the Dreams of Wealth series of books (www.dreamsofwealth.com).

Disclosures

The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be construed as any form of tax advice, or to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. To the extent that this material concerns investments or securities, it is not intended or written to be construed as any form of investment, financial planning, or other professional advice. Any material that includes or references investment performance is not intended to imply or guarantee any future investment performance; past performance is not indicative of future returns, all investments are subject to risk, and you may lose the principal you invest. You should seek independent advice that is tailored for your specific personal circumstances from a qualified professional before taking any action based on the information contained herein. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

By clicking on any of the links, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party Web sites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them.

Copyright ©2024 Stevens Visionary Strategies LLC. All rights reserved.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means without the prior written consent of the owner except as expressly permitted by U.S. copyright law.